Welcome to the June 2025 edition of Trust in Transition. This monthly newsletter, compiled by WISER scholars, is your gateway into finance, technology, and trust in Africa. Each month, the Substack features WiSER scholars unpacking the current events and stories shaping their research.

Inside This Edition

🌍 WiSER on the Move

💡 ID4Africa 2025:

“Africa First in All That We Do” Fatima Moolla | Doctoral Fellow | Trust

“Hacking Identity, Building Trust: Africa’s Youth-Led Future” Andrew Amstrong Musoke | Senior Research Engineer | Upanzi-Network CMU Africa

✏️ Contributions:

In this edition, Wiser Trust scholars and affiliates are reading the following:

“Whither the Hegemon?” Keith Breckenridge | Professor | Trust

“Bringing the Banks Back” Laura Phillips | Senior Researcher | Trust

“Nigeria’s Telco’s-banks commercial (USSD) wars come to an end, for now” Babatunde Okunoye | Doctoral Fellow | Trust

“From Zero to Hero and back to Zero? The Ghana Cedi’s recovery might be short lived” Caroline King | Doctoral Fellow | Trust

“CBN Launches Digital BVN for Nigerians Abroad, Targets $1 Billion Monthly Remittances - Mobile Money Africa” Hannah Krienke | Doctoral Fellow | Trust

This month’s edition of Trust in Transition centres on digital identity in Africa, with reflections from ID4Africa 2025 in Addis Ababa. It explores questions of ownership, inclusion, and trust, both in technologies and institutions. We feature insights from the ground, highlight youth-led innovation, and share key updates on mobile money, remittances, and digital finance across the continent.

WiSER on the Move🌍

WiSER Fellows Caroline King, Hannah Krienke and Georges Macaire Eyenga attended the “Cash in Crisis in Africa: Navigating Financial Realities in Times of Disruption” Conference hosted by MIASA at the University of Ghana.

Doctoral Fellows Caroline King and Hannah Krienke presented their on-going research on Mobile Money and Eco-cash in Zimbabwe, respectively.

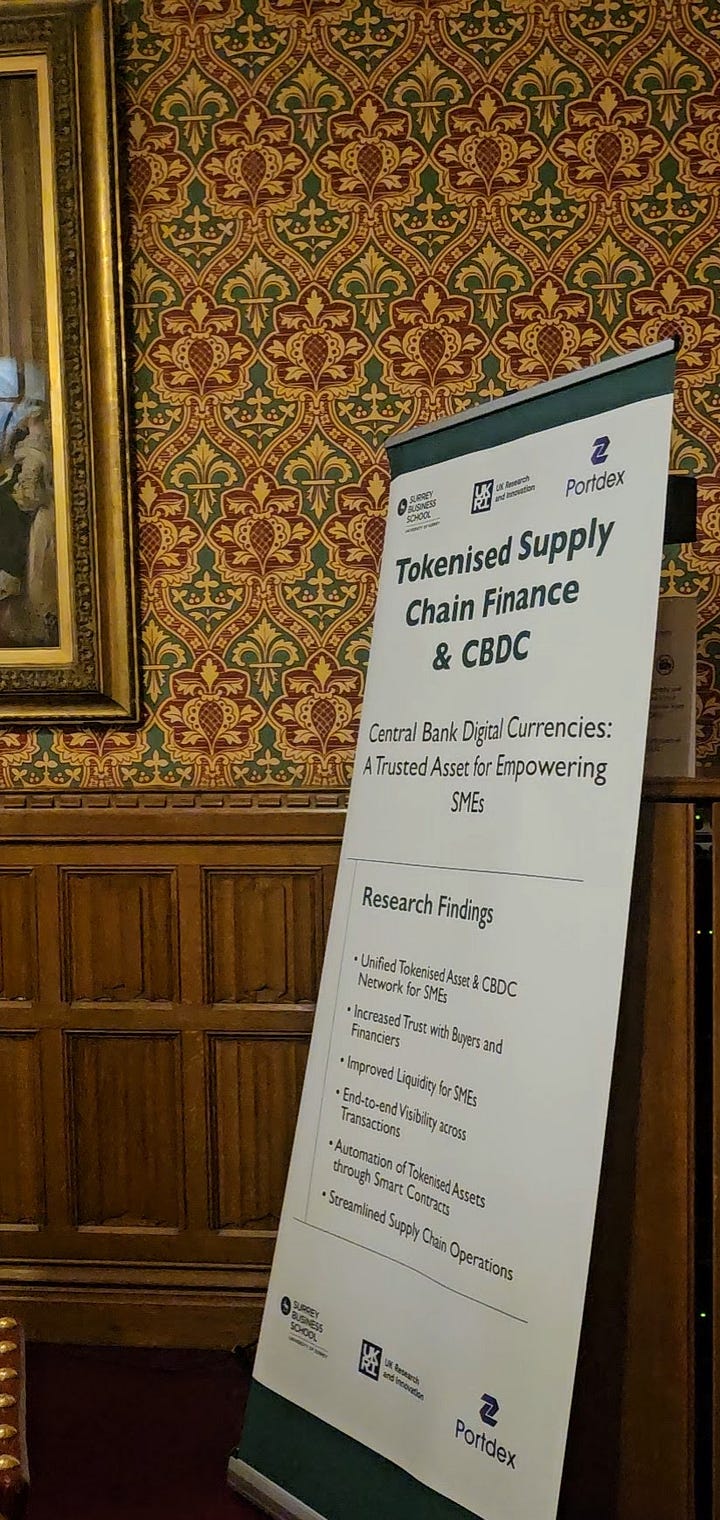

As part of her Visiting Fellowship at the POLIS in Cambridge, Doctoral Fellow Fatima Moolla attended various events, including a presentation as part of St Catherine’s Political Economy Seminar Series, What are we learning from 2,500 years of Cash Transfers? by Ugo Gentilini and the special event on Tokenised Supply Chain Finance & Central Bank Digital Currencies held at the House of Lords, Palace of Westminster London.

💡 ID4Africa 2025:

Between May 20th and May 23, PhD Research Fellows Fatima Moolla and Babatunde Okunoye attended the ID4Africa 2025 AGM held in Addis Ababa, Ethiopia.

“I attended ID4Africa 2025 in Addis Ababa, Ethiopia from May 20 - 23, where I had significant interactions with influential personalities in the global Identification for Development (ID4D) movement, including Engineer Aliyu Aziz, the former Chief Executive of Nigeria's National Identity Management Commission (NIMC).”

Africa First In All That We Do

Fatima Moolla | Doctoral Fellow | Trust

When we say things like from Africa, for Africa, in Africa, we need to be more explicit about what we actually mean. Slogans like these are easy to rally behind, but harder to substantiate especially when the context doesn’t always align with the narrative.

At this year’s ID4Africa conference in Addis Ababa, the guiding principle was framed as a bold declaration of purpose: Africa First in All That We Do. In his opening remarks, Dr. Joseph Atick laid out what he called six “disruptive forces” shaping the urgency around digital identity. Digital transformation, he argued, is no longer optional – it’s a necessity. At the same time, the geopolitical landscape is shifting, and public finances are under immense strain as states confront mounting demands with shrinking fiscal space. The 2030 Sustainable Development Goal deadline is fast approaching, particularly target 16.9, which commits to providing legal identity for all. Meanwhile, artificial intelligence is accelerating rapidly, driving a need for better data, infrastructure, and interoperability. And all of this is unfolding in a context where cyberattacks are becoming more frequent and more severe – pushing cybersecurity to the level of national defense.

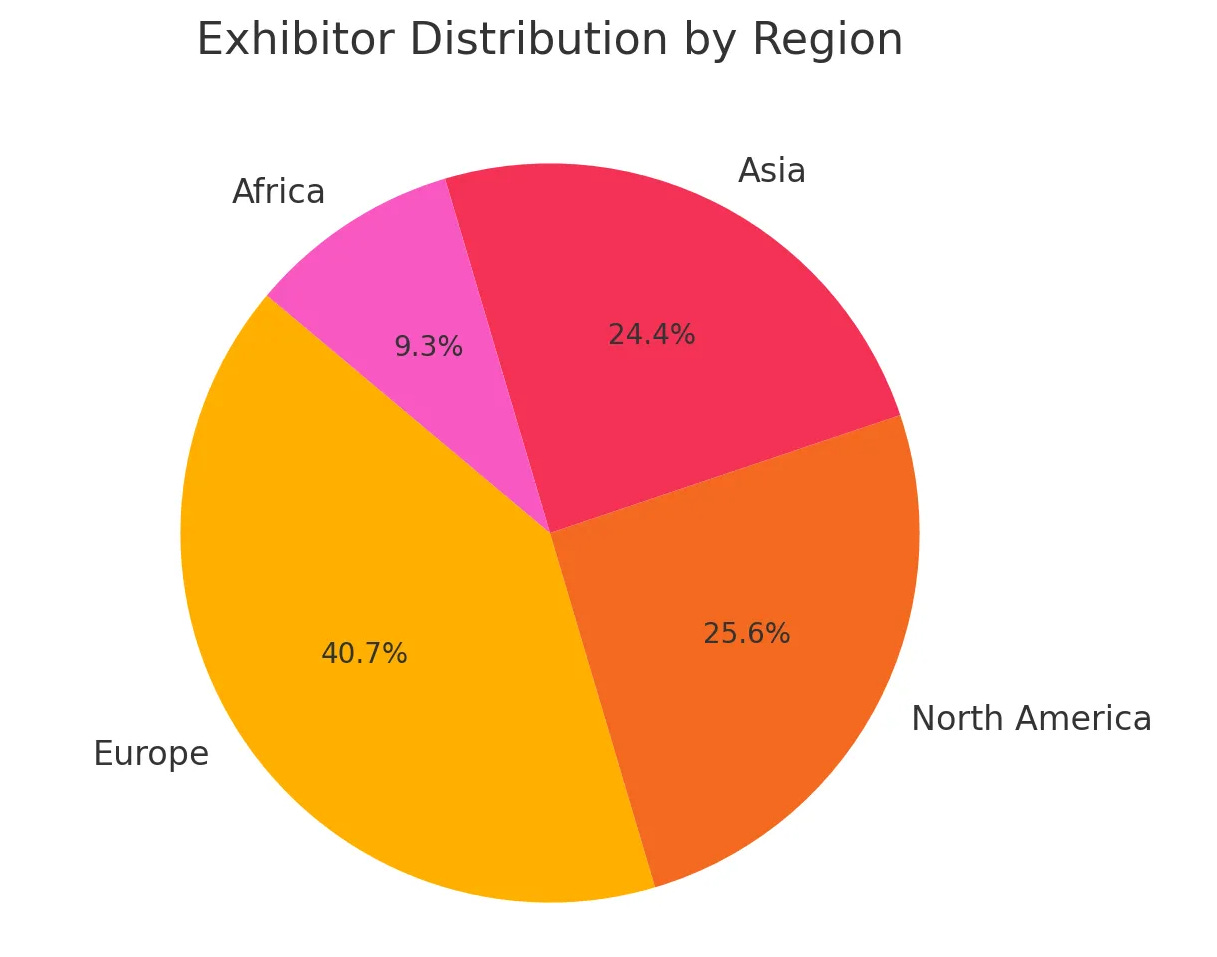

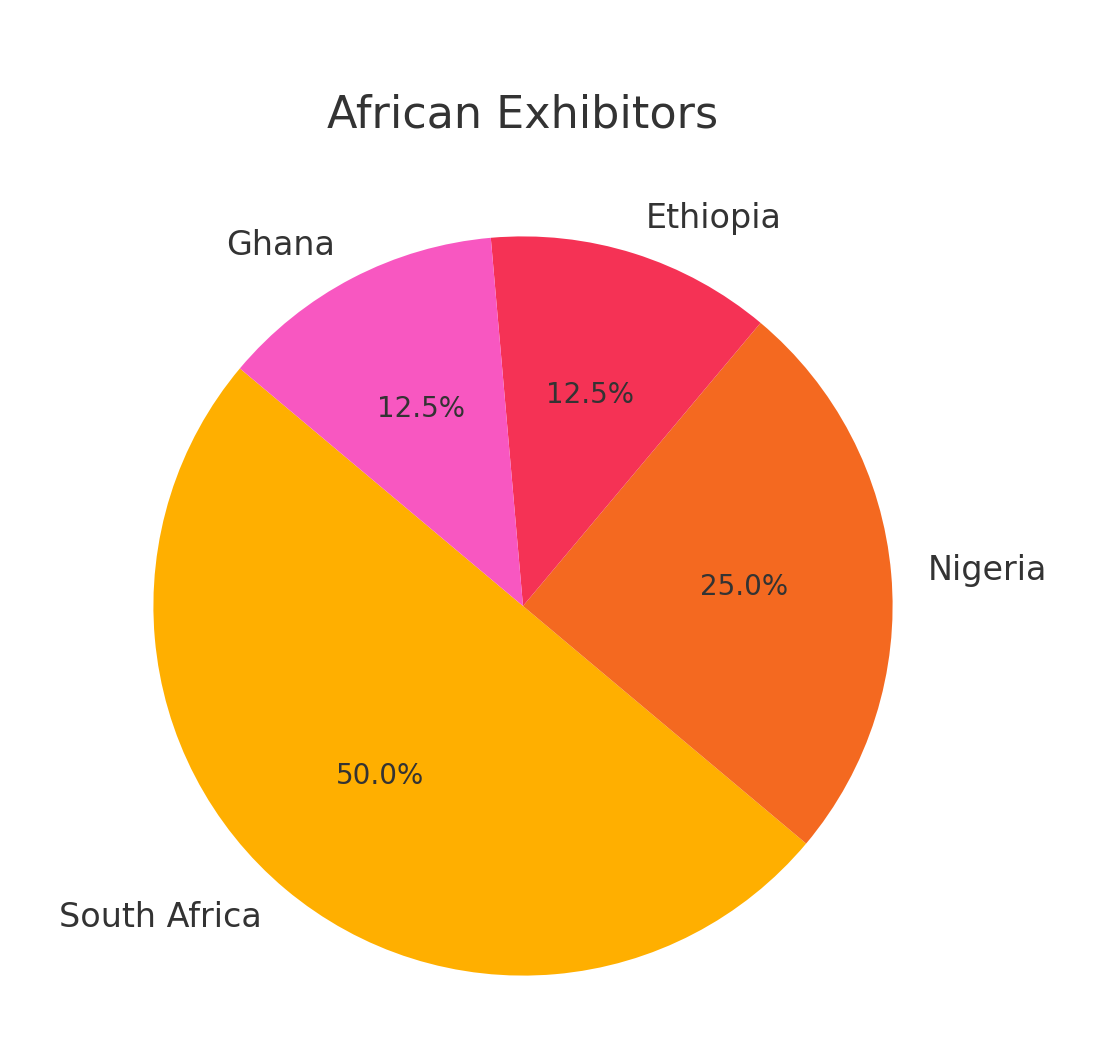

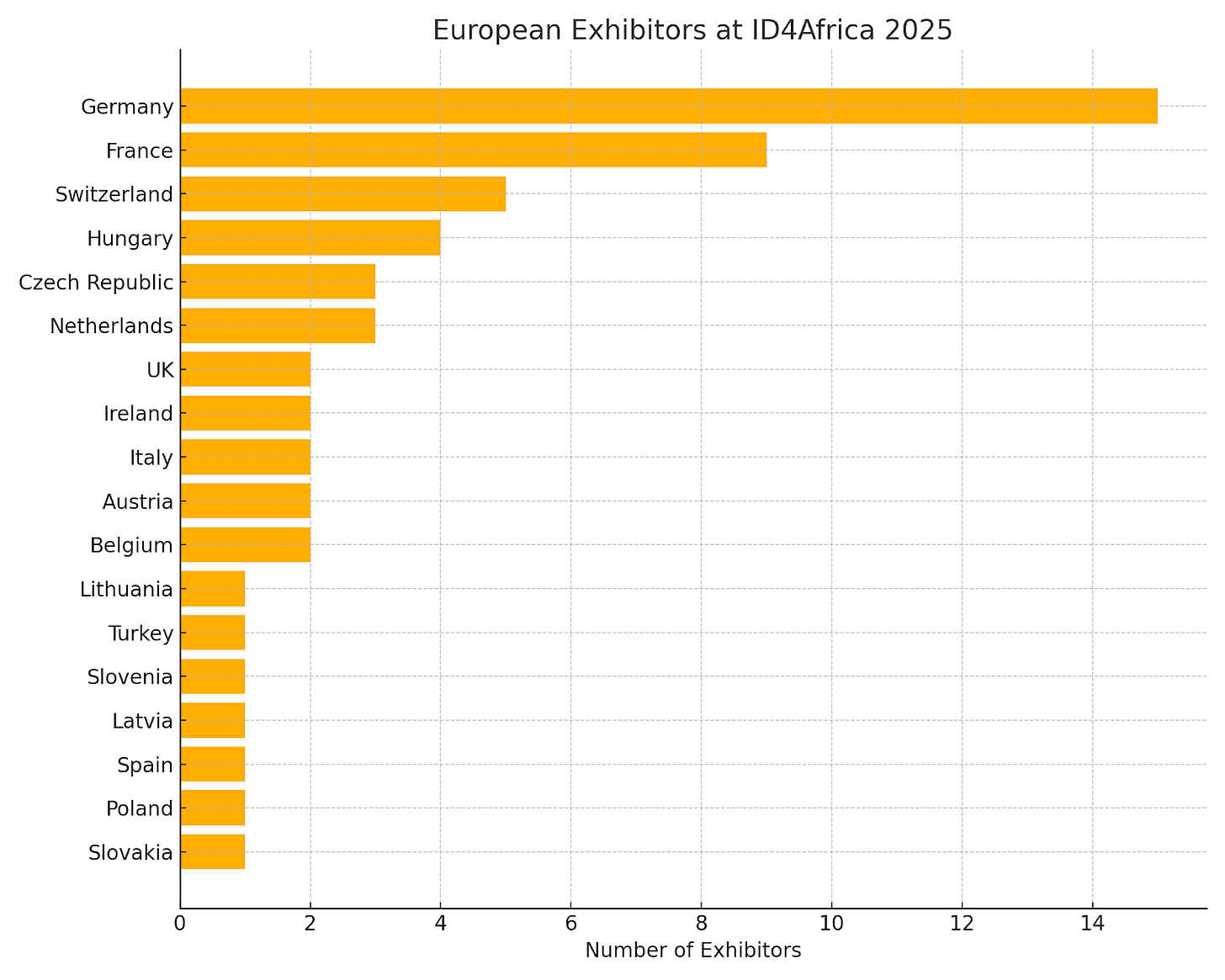

This moment, he argued, calls for African self-reliance: the continent must trust in its own capabilities and secure its own assets and interests. But is it really Africa First in All That We Do? The numbers suggest otherwise. Out of 120 exhibitors at what was called “the world’s largest ID4D exposition,” only seven were from African countries. Four from South Africa, two from Nigeria, one from Ghana. The remaining 113 came from Europe, North America, Asia, and elsewhere.

This isn’t a rhetorical misstep. It’s a structural fact. We are witnessing a system still overwhelmingly built for Africa – but not from Africa nor by Africa. So when we say Africa First, we need to ask: is it Africa first on stage, or Africa first in ownership, production, and power? To be clear, this is not a failure of the conference itself.

ID4Africa made visible efforts to diversify participation, reporting a 100% increase in African speakers and a 60% increase in the number of African countries featured on panels. These are meaningful strides in representation. But the imbalance on the expo floor reflects a different truth: how unevenly innovation ecosystems are distributed. It’s also important to note that the expo isn’t a neutral showcase, it’s a revenue stream. Exhibitors pay for the opportunity to display their products, and those fees help fund the broader event. In a market where African firms are already undercapitalised and struggling for recognition, this model inadvertently reinforces existing power asymmetries. It doesn’t matter how good your idea is if you can’t afford the booth.

European firms continue to dominate the identity technology space and are now exporting their frameworks and products into African markets. Meanwhile, African entrepreneurs are expected to compete without the same level of capital, infrastructure, or political support – resources still overwhelmingly concentrated in the Global North. Even with those resources, one barrier remains formidable: perceived trustworthiness. Companies from Germany or the Netherlands arrive with presumed legitimacy. Their presence in donor-funded spaces is rarely questioned. In contrast, a startup from Nigeria or Kenya, no matter how technically solid, is asked to prove its worth at every turn. This isn’t just about technical capability or financial capacity. It’s about geopolitics, perception, and long-standing assumptions baked into global procurement logic: that foreign equals credible, and local means uncertain.

Alongside the main event, a different story was unfolding. The Digital ID Hackathon wasn’t run by ID4Africa; it was conceived in a research lab in Kigali and scaled by The Upanzi Network at CMU-Africa. Over months of preparation, it connected developers and students across 23 countries, turning local problems into actionable prototypes. Initiatives like this matter. They make space for African-led experimentation. But they’re also vulnerable. They’re easy to parade for PR, easier still to drop once the cameras stop rolling. Without long-term investment, procurement, and institutional support, even the most promising innovations remain stuck in a cycle of applause-without-adoption. This is not a critique of the Hackathon. It’s a critique of the digital identity landscape that still fails to back African ideas with the resources they need to scale. When we celebrate talent without investing in long-term capacity, local ownership remains out of reach. Innovation stays peripheral. And that leads to a deeper discomfort: the kinds of identity systems being marketed to African governments were not designed with inclusion in mind. Many were never built for public empowerment – they were built to manage, extract, or control. Now they’re being rebranded as solutions for African governance. We are being asked to build public goods using architectures that were never meant to serve us. This doesn’t mean rejecting digital identity. It means interrogating its logic. If we’re serious about African self-reliance, then we have to ask: why do we still view local companies as risky, while assuming foreign firms are credible by default?

Championing African talent can’t just be something we say into a camera. It needs to show up in procurement contracts, in funding decisions, in institutional trust. Yes, the Hackathon mattered. But it cannot be the exception that proves the rule. If Africa First in All That We Do is going to mean anything, it has to echo long after the hashtags fade.

Guest Feature 💡

Reflection: Hacking Identity, Building Trust: Africa’s Youth-Led Future

Andrew Amstrong Musoke | Senior Research Engineer | Upanzi-Network CMU Africa

Coordinated efforts across Africa are propelling the continent towards a digital future. At the heart of this transformation lies digital identity – not just as a bureaucratic mechanism, but as a bridge for trust, inclusion and sovereignty.

Over the past decade, I have worked in private fintech and contributed to the assessment of open source digital public infrastructure (DPI). These systems – like MOSIP (for digital Identity) or Mojaloop (for digital payments) – are designed to be open, inclusive and interoperable. My guiding question has always been: how can we support sustainable, trustworthy, Afro-centric implementation of public technologies? The more I have worked on these questions, the clearer it has become that capacity building – especially at the local level, is foundational.

In 2024, in partnership with MicroSave Consulting, the Upanzi DPI Network launched the African Digital ID Hackathon, a capacity building platform for African youth to develop and prototype solutions to real-world problems they face in their communities. With a focus on context, the Hackathon unfolded as a series of regional competitions supported by regional partners. Through the eight months from September 2024, the Hackathon piloted in Rwanda, launched in Morocco and Senegal and culminated in a final showcase at the ID4Africa Annual General Meeting (AGM) – the continent's largest gathering of digital identity stakeholders.

Across 23 countries, more than 600 university students, 30% of them women, participated. With guidance from volunteer mentors, teams worked to turn lived experiences into novel, high-impact digital ID solutions that responded to real needs on the continent and globally.

Having attended a few ID4Africa AGMs before, I have seen the intention behind the platform firsthand: to give countries space to validate pilot strategies, share wins, and engage in collective problem-solving. But one thing has often been missing: a pipeline for locally rooted problems and homegrown solutions to feed back into the system. This is the gap that the Hackathon sought to address. As digital trust frameworks take shape globally, the Hackathon wanted to ensure that both African values and the voices of the African youth are embedded in the DNA of next generation systems. We started with problems, not products. That focus allowed us to build from the ground up.

Governments often struggle with ID adoption, but maybe the issue isn’t resistance, its misalignment. To build trust, systems need to offer real, visible value. The winning prototype, developed by a team of Senegalese students, demonstrated how digital ID could help first responders access critical medical data (like blood type or allergies) when a patient is unconscious. It reframed ID as something urgent and lifesaving, a tool of safety and urgency, not just an extractive legal requirement.

The Hackathon drew hundreds of applications, produced promising prototypes, and sparked real energy at the ID4Africa AGM. That momentum tells us something important: the continent is ready to drive its own digital transformation, with the capacity to do so. But it also raises a tougher question: will the ecosystem support these ideas, or simply applaud them? Adoption will be the true test of whether institutions are ready to back African innovation – not just to celebrate it.

We are already laying the groundwork for 2026 with plans to include more countries, institutions, mentors and students. We have also launched an ambassador program and are exploring ways to involve private actors as well.

For me, this journey has been both grounding and hopeful. It affirmed what I’ve long believed: the infrastructure of trust doesn’t start with code. It starts with people, and the courage to give them a voice. In the years ahead, I’ll continue to work at the intersection of governance and technology, supporting citizen-driven policy and public infrastructure with a focus on building trust through ownership.

✏️ Contributions:

“Whither the Hegemon?”

Submitted by Keith Breckenridge | Professor | Trust

As Gill Tett wrote this week in the FT, central bankers are starting to worry that the US will not continue to support the dollar swap lines that have kept the world economy on its feet repeatedly over the last half century. In recent years the swap lines have been used twice in volumes of around half a trillion dollars : during the first months of the Covid epidemic and, again, during the 2008 global financial crisis. Aditi Sahasrabuddhe, author of the new book, Bankers’ Trust, asks in her piece in the FT, “Will the Fed continue to assume its global responsibilities?” The swaps emerged from the lessons of Charles Kindleberger’s work on the Depression, which showed that global economic collapse was made possible by the interregnum in global finance between the decline of London and the rise of New York, leaving the world without a stabiliser of last resort. Given the MAGA coalition’s ferocious hostility to fractional lending and quantitative easing, Tett and Sahasrabuddhe are surely correct to worry about the global financial consequences of any Trump appointment to chair the Fed. The important question is whether a new stabiliser of last resort will emerge before the next major crisis.

“Bringing the Banks Back”

Submitted by Laura Phillips | Senior Researcher | Trust

If the discussion on this podcast is to be believed, South Africa’s crypto-traders and exchange managers are far from enthusiastic about mainstream banks’ new-found enthusiasm for cryptocurrencies. In conversation with financial journalist Ciaran Ryan, AfriDAX CEO suggests that by allowing crypto purchases, banks are forcing themselves into an otherwise unmediated market that bypasses national institutions and regulations. Many early crypto adopters were particularly attracted by the decentralised nature of the currency and its claim to offer radical economic sovereignty. As crypto has become increasingly popular, especially in the past few months, conventional banks, bound by national laws and regulations, are trying to find their feet in the market. Their deep pockets and well-resourced financial architecture gives them, according to AfriDAX, a more secure foot than many crypto-exchanges. This may encourage crypto buyers to do all their trading through the banks - something that is complete anathema to crypto-purists. At this stage though, it is hard to know how banks will navigate the changing environment. While Crypto Asset Service Providers (CASPs) are subject to the Financial Intelligence Centre Act, much about their status is still uncertain.

“Nigeria’s Telco’s-banks commercial (USSD) wars come to an end, for now”

EXPLAINER: Everything to know about NCC's new USSD billing model | TheCable

Submitted by Tunde Okunoye | Doctoral Fellow | Trust

The Nigerian Communications Commission (NCC) have stated that starting June 3, 2025, USSD transaction charges will no longer be deducted from the bank accounts of customers. Instead, these charges will be taken from users’ mobile phone airtime. The new model ends a long commercial war (which began in 2019) between telcos and banks over the revenues derived from USSD transactions. USSD – “Unstructured Supplementary Service Data”, allows mobile phones to interact with telco networks and then access services such as banking by dialling specific codes without needing an internet connection. The idea was to further expand financial inclusion for those without internet access.

Despite this good intention however, the initial model where banks deducted fees for each USSD transaction from customers’ bank accounts drew resentment from telcos who felt they were being excluded from the revenues of a service facilitated on their infrastructure. These fees have totalled ₦250 billion since 2019. MTN was the most affected, having received only ₦32 billion of the ₦72 billion owed to it by banks. Under this new model, each USSD session will now cost ₦6.98 per 120 seconds, billed by telcos. Revenues go directly to the telcos. Separately, experts have suggested that this commercial war, which displayed the financial and corporate strength of the telcos, was a factor in the acceleration of the development of banking apps by banks, and by their collusion to exclude the telcos from lucrative segments (such as credit) of the Nigerian digital finance market.

“From Zero to Hero and back to Zero? The Ghana Cedi’s recovery might be short lived”

Submitted by Caroline King | Doctoral Fellow | Trust

Towards the end of May and beginning of June 2025, the Ghana Cedi has appreciated against the USD at a startling rate, with headlines rating it as the best-performing African currency. The inflation rate dropped to 18.4%, the lowest in three years, after multiple years of the Ghanaian currency's steady depreciation and associated economic difficulties. Some suggest that the new Government, in power since January 2025, is running a tight ship and making strides in stabilizing the economy of Ghana. Soaring gold prices and reduced oil price have also eased pressure on local pricing. Others point to the general depreciation of the USD in the last month as tumultuous US-politics have impacted the global market.

This positive development has led Ghanaians to exchange their Ghana Cedis for USDs, leaving banks and forex bureaus with a shortage of physical dollars and customers unable to access hard currency. This has led to people being turned away and asked to return at a later time to withdraw money. The shortage is in parts attributed to declining remittances, delays and demands in the import/ export sector. A persisting shortage of physical dollars could lead to renewed inflation or potentially boost black market activity. But a nearing IMF disbursement can hopefully alleviate some of the issues and help the Bank of Ghana in stabilizing the Ghana Cedi.

The appreciation of the currency has changed little in the actual pricing of goods on the ground, as SME owners remain mistrustful towards the volatility of the Ghana Cedi.

Submitted by Hannah Krienke | Doctoral Fellow | Trust

The Central Bank of Nigeria has taken essential steps to create a digital platform that allows Nigerians living abroad to obtain bank verifications online, thereby eliminating the need for them to travel home to acquire them in person. The platform, dubbed the Non-Resident Bank Verification Number (NRBVN) aims to address the growing need for those living in the diaspora, who are often unable to access financial services in Nigeria due to physical barriers that require in-person verification.

The process requires users to upload their identity documents, personal information, and a live photo as part of the procedure. Once they have been successfully validated, users can then select their preferred bank. Additionally, Nigerians by descent can also access the system by providing valid proof of citizenship through parentage.

The rollout of this platform is anticipated to boost the volume of remittances received, as NIBSS Managing Director Premier Oiwoh states that the strict regulations within the current banking systems restrict many non-residents from investing back home. He further advocated for the incorporation of the latest technologies to ease verification processes, such as biometrics, liveness detection, optical character recognition (OCR), and AI-powered identity validation. By utilising these technologies, it is hoped that Nigerians living abroad will have greater access to investment tools, and the Nigerian economy will be bolstered with an increased inflow of foreign currency.

Given the significance of remittance flows within Africa, this move may potentially create alternative channels for remittances through the involvement of additional banks. However, it is essential to consider what security mechanisms are put in place to eliminate the potential for fraudulent activities.

Trust in Transition is a Substack, by the Trust Project, exploring the intricate interplay between trust, finance, and societal evolution within the African context. This space serves as a lens into the fascinating dynamics of trust infrastructures, financial landscapes, and their transformative impact on Africa's economic pathways.