Welcome to the November edition of Trust in Transition. This monthly newsletter, compiled by WISER scholars, is your gateway into finance, technology, and trust in Africa. Each month, the Substack features WiSER scholars unpacking the current events and stories shaping their research.

October Recap 🗓️

On Thursday, 26 September the eighth lecture in the Unified theory series was on Trust in computing, presented by Keith Breckenridge in conversation with Faeeza Ballim. The lecture examined the ways that institutions – universities, firms and governments – increasingly insist that computers, networks and input devices can be used to build trust – perhaps because these devices generate and exploit the statistical evidence that Ted Porter has tracked as key to the ascendancy of numerical regulation in the 20th century. The new plans for Digital Public Infrastructure especially in the IndiaStack, Open Banking and machine learning in government will accelerate the existing commitment to computational networks as instruments of trust. Yet, interestingly, as Donald Mackenzie has shown, computer scientists and mathematicians have a long history of bitter conflict over the reliability of mechanised computational reasoning. This principle – that computers, their networks and users should never be trusted – is close to the core argument of modern computer security, best demonstrated in Ross Anderson's life's work. Far from solving the problems of mistrust in computing and statistical evidence, the recent ascendancy of human-like deep-learning models intensifies these disputes within computer science, and in society, with particular regulatory problems on the African continent. Yet the same network arrangement – as Schaffer and Shapin, Latour and Mackenzie's work on the Black-Scholes equation have all shown – has supported a particular kind of experimental science, the automation and centralisation of decision-making and the expansion of scales that structure the world.

WiSER on the Move🌍

From the 9th to 11th of October, the Trust Project co-hosted a conference with Fidemo and Alameda Institute titled ‘Beyond the Apocalypse: Rethinking Capitalism, Democracy, and Crisis in South Africa. The conference brought together young scholars, activists, politicians, policy thinkers, and cultural practitioners to consider 30 years of South African democracy. More information can be found here.

During her visiting fellowship at Carnegie Mellon University Africa, Fatima Moolla attended the Digital ID Hackathon awards ceremony hosted by the Upanzi-network in Kigali Rwanda. The Digital ID hackathon invited students to develop high-impact use cases for Digital ID that foster regional integration and inclusion.

Caroline King attended the Anton Wilhelm Amo Lecture at the University of Ghana, where Professor Toyin Falola spoke on the topic of “Ancestral Knowledge for Contemporary Transformation.” The lecture brought together academics from the MIASA, Institute of African Studies and Philosophy Department of the University of Ghana in Accra on 15 October 2024.

On the 8th of October, Keith Breckenridge and Jonathan Klaaren attended the WiSER event “After the Storms — Academic Freedom and Leadership in Higher Education.” This conversation, between two former university vice-chancellors Adam Habib and Max Price, explored the post-apartheid dilemmas of university leadership through the lens of academic freedom. The discussion was moderated by Hlonipha Mokoena.

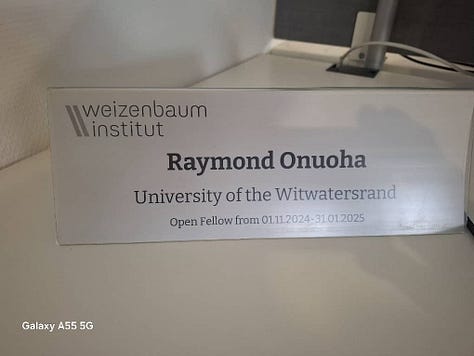

Postdoc Fellow, Dr Raymond Onuoha will be active as a Visiting Fellow at The Weizenbaum Institut Berlin, Germany from November 2024 to January 2025. While there, his research will extend his work around digital identification as a trust constraint to digital financial services in relation to the German ecosystem.

⭐ The WiSER Feature:

“Ain’t no party like a FATF party: The long term effects of greylisting on South Africa’s financial sector” Laura Phillips

Read below ⬇️

In this edition, Wiser Trust scholars and affiliates are reading the following:

“Financial Times: “It is hard to exaggerate Musk’s role in poisoning trust” Keith Breckenridge | Professor | Trust

“SIM-NIN linkage: A major driver of digital ID adoption in Africa” Raymond Onuoha | Postdoc Fellow | Trust

“Echoes of the Mines: Elon Musk and the Legacy of Economic Extractivism” Fatima Moolla | Doctoral Fellow | Trust

“Moniepoint attains Unicorn valuation” Tunde Okunoye | Doctoral Fellow

“Greater trust in the state enhances citizens' willingness to pay taxes” Georges Eyenga | Postdoc Fellow | Trust

“Can Zimbabwe’s legal framework promote foreign investment through the streamlining of visas?” Hannah Krienke | Doctoral Fellow | Trust

“Ghana is gearing up for its election in December” Caroline King | Doctoral Fellow | Trust

“Quality of Life and Trust in Municipalities” Joel Pearson | Postdoc Fellow | Trust

This edition of Trust in Transition delves into the intersections of technology, governance, and trust across African contexts. Highlights include analyses of digital ID's role in Africa, Elon Musk's influence on public trust, and South Africa’s greylisting and its implications for financial compliance. Other pieces explore Zimbabwe’s visa reforms and Gauteng’s local governance, examining how policy and regulatory frameworks shape public trust and community engagement. Each contribution offers insight into the evolving dynamics of trust in state and financial structures across varied landscapes.

The WiSER Feature 📝

Ain’t no party like a FATF party

The long term effects of greylisting on South Africa’s financial sector

On 24 February 2023 intergovernmental financial watchdog, the Financial Action Task Force (FATF), announced that South Africa would be greylisted. Concerned about illicit financial flows and, in particular, terrorist financing, FATF added South Africa to a list of twenty other countries that, in their words, would be “subject to increased monitoring” (FATF, 2023). Though industry insiders and commentators anticipated the greylisting, it nonetheless sent the financial sector into a spin, panicked about the effects it would have on South Africa’s already struggling economy.

In an effort, first to prevent, and then remove South Africa from the greylist, National Treasury has been very busy. With the threat of greylisting looming, the South African Parliament passed the General Laws (Anti-Money Laundering and Counter Terrorism Financing) Amendment Act in December 2022 in an attempt to tighten loopholes in South Africa’s financial sector; similarly the 2023 National Budget announced significant legislative changes, such as provision to tax non-resident beneficiaries of South African trusts (Honiball, 2023); the National Prosecuting Authority brought 84 new prosecutions for money laundering crimes in the period since greylisting (NPA, 2023/2024, p. 43); and in September 2024 the Prudential Authority issued Old Mutual Life Assurance Company with a fine of R15.9 million for failures to adequately comply with the Financial Intelligence Centre Act.

For the most part analysts and industry insiders discuss the greylisting in terms of its implication for international financial flows, focusing on the risks associated with doing business with a greylisted country and the additional administrative and compliance requirements for such business (Adshade, 2023). In August 2023 three southern African based UN bodies co-authored “A Note on Possible Socioeconomic Implications [of South Africa’s greylisting]” (2023). Unless South Africa acts swiftly, they warned, there would be negative effects on the flow of foreign capital, the cost of foreign trade, the cost of government borrowing, and South Africa’s international reputation. Media and industry reporting suggests that until South Africa gets off the greylist, there will be “significant implications for its economic growth and global competitiveness” (Webber Wentzel, 2023).

However, there are other – perhaps unanticipated effects - of the greylisting that will have far longer lasting implications on the financial sector. As Anthony Amicelle argues, the “management of the ‘dirty money’ problem is first and foremost located at the interface between finance and security” (2018, p. 22). This has produced the “financialization of security” and the “securitization of financial systems”(Ibid). The security sector may have much to say about this, but there is little doubt how this dynamic has played out in the financial industry: as one compliance officer in South Africa explained, FATF’s requirements act as a “business interrupter,” requiring the financial services industry to juggle the demands of for-profit business with the threat of sanction by the supervisory bodies (Anonymous, 2024). In short, the institutional environment for the implementation of anti-money-laundering policies has heightened the contradictory pressures in the financial sector. Even before the greylisting the Compliance Institute of Southern Africa – the professional body for southern African compliance professionals – noted that compliance officers work in the “face of ‘push back’ or being called the ‘business prevention officer’” (Mathole and Pretorius, 2023). A bank compliance officer in the UK said similarly: the purpose of a bank is to make money, not to do police work. However the role we play is not far from an internal police officer for financial institutions, which can generate tensions with our commercial services.” (Amicelle, 2017, p. 217). The panic around greylisting has only intensified this dilemma, imposing the demands of national security onto financial services.

The haste with which South Africa has tried to address FATF’s greylisting is also likely to have long term implications for the structure and functioning of the country’s financial sector. Across its jurisdictions FATF has used enforcement and greylisting as a tool to drive sectoral change. But the threat of punitive actions has created perverse incentives to get off the FATF greylist, rather than truly prevent illicit money flows. As some have suggested, there is a danger that South Africa’s financial sector will either make only cosmetic reforms to the industry or invest energy in parallel institutions that simply allow the country to tick off FATF’s requirements (Davis and De Meyer, 2024). In public discussions about forestalling the greylisting, civil society organisations Amabhungane and Corruption Watch noted their concern at the rapid speed at which anti-money laundering legislation had been drafted. As they explained in their submission to Parliament’s Standing Committee on Finance:

“…we are concerned at the impact this haste has had on the content of the Bill and on the short time frame for public participation… The issues addressed by the Bill are complex and we are disappointed that the Ministry of Finance, Parliament and the public have not been given the time to grapple fully with these issues.” (2022, p. 4)

If Amabhungane, Corruption Watch and others are to be believed, the frantic efforts to get off the greylist might radically change the incentives shaping South Africa’s financial sector.

Finally, we might also consider the growth of the compliance industry and the strengthening of government regulators in light of the greylisting. Attuned to the relationship between terrorism and finance, the global field of compliance started growing apace in the period after the 9/11 attacks, along with regulatory bodies’ increased muscle. Both compliance and regulation have only increased with concerns about money-laundering in recent years (Tsingou, 2018), marking a noteworthy shift from previous generations’ commitment to self-regulated markets. For example, the Compliance Institute of Southern Africa was established in 2003, and while it has expanded in sync with international trends it is also responsive to dynamics on the ground. In 2023 – the year of South Africa’s greylisting – the Institute offered new courses in the field of Anti-Money Laundering, now a prized certification for compliance officers looking to respond to increasingly fierce regulators (CISA, 2023). Greylisting has added a new pressure point to the compliance industry and further strengthened regulatory bodies, shaping modes of operating within the financial services sector. '

To paraphrase Tupac Shakur then: few may experience FATF as a party, but it’s clear that even when South Africa gets off the greylist, the effects of the ruling don’t stop.

References

Adshade, Julian (2023) ‘South Africa’s Greylisting - What does it mean?’ Sable International.

Amicelle, Anthony (2018) ‘Policing through misunderstanding: insights from the configuration of financial policing,” Crime Law and Social Change, 69: 207 – 226.

Anonymous (2024), Interview..

CISA (2023) ‘Welcome to the December 2023 Newsletter,’ 2023.

Corruption Watch and Amabhungane (2022) ‘Joint Statement to Standing Committee on Finance.’

Davis, Kent and Anel De Meyer (2024), ‘The Chamber of Financial Secrets: Uncloaking the Mysteries of Administrative Penalties,’ FANews.

FATF (2024), ‘Jurisdictions Under Increased Monitoring.’

Honiball, Michael (2023), ‘The FATF, Trusts and Transparency in South Africa,’ Werksmens Legal Brief.

https://www.corruptionwatch.org.za/fact-sheet-on-south-africas-fatf-greylisting/

Mathole, Alex Motshwanetsi and Harry Pretorius (2023) ‘Open letter to encourage transformative debate for the compliance industry,’ CISA.

National Prosecuting Authority (2023/2024), ‘Annual Report.’

Tsingou, Eleni (2018) ‘New Governors on the Block: The Rise of Anti-Money

Laundering Professionals,’ Crime Law and Social Change, 69: 191 – 205.

United Nations South Africa (2023), ‘Greylisting in South Africa. A Note on Possible Socioeconomic Implications.’

Webber Wentzel (2023), ‘South Africa has been greylisted; what are the implications for the country going forward?’ https://www.webberwentzel.com/Pages/default.aspx

✏️ Contributions:

“Financial Times: “It is hard to exaggerate Musk’s role in poisoning trust”

Submitted by Keith Breckenridge | Professor | Trust

As the US election finally comes to a close, the Financial Times (FT) is worried about Elon Musk undermining trust. The story quotes an anonymous election lawyer from Washington DC to make a point that is now almost common sense: “It is hard to exaggerate Musk’s role in poisoning trust.” But the FT piece is chiefly based on this detailed Bloomberg data analysis of Musk's X posts. Interestingly, there are some signs of trust here — in X’s efforts to use human intermediaries to fact-check — but this worry about the political effects of untested, and often ridiculous, claims on social media is arguably a good example of what Pippa Norris calls political credulity. It is important to remember her point that democracy depends on scepticism – and institutions, including election commissions – need to be prepared to defend their procedures.

“SIM-NIN linkage: A major driver of digital ID adoption in Africa”

Submitted by Raymond Onuoha | Postdoc Fellow | Trust

All active SIM cards in Nigeria now linked to digital ID, regulator claims

The SIM-NIN linkage initiative in Nigeria highlights an essential advancement in digital identity (ID) adoption, addressing security, governance, and social inclusion. Launched to tie SIM cards to a National Identification Number (NIN), the initiative aims to curb crime, including kidnappings and insurgencies, by allowing authorities to trace mobile activity to verified users. Despite initial challenges and public discomfort, the Nigerian Communications Commission’s (NCC) recent confirmation of universal compliance represents a significant milestone in Africa’s broader drive toward secure, digital governance frameworks.

In the African context, where informal economies and limited government records complicate citizen verification, digital ID systems are critical for safe financial services, health access, and secure communication. Nigeria’s success with SIM-NIN linkage not only enhances national security but also sets an example for neighbouring nations striving for similar digital ID adoption. The linkage initiative underscores the vital role of technology in fostering trust in public institutions while expanding digital inclusivity, a priority for sustainable development across the continent.

“Echoes of the Mines: Elon Musk and the Legacy of Economic Extractivism”

Submitted by Fatima Moolla | Doctoral Fellow | Trust

With the recent Nobel Prize in Economics being awarded to Acemoglu, Johnson, and Robinson (AJR), their work on "extractive economies" and elite power feels particularly relevant. Efthimos Karayiannides shines a light on the parallel between Silicon Valley's tech industry and South Africa's mining sector. He suggests that Elon Musk and other South African tech moguls aren't merely products of Apartheid-era ideologies but rather of capitalist models forged in both South African mining practices by implementing corporate models that prioritised centralised control, monopoly, and exploitation, inspired by American railroad company monopolies -- features that defined and extractive economy built to maximise profit over social welfare.

These imposed structures didn't just establish a template for South Africa's economy but later made it back to America to influence Silicon Valley's approach to business. Musk's practices align with this legacy, consolidating power and resources in ways AJR would recognise as hallmarks of an extractive system. Critics of AJR argue that their theory lacks cultural nuance, yet in looking at Silicon Valley, their ideas offer a compelling framework. Today’s tech elite, much like their mining counterparts, accumulate wealth by monopolizing innovation and influence. Silicon Valley, then, is an extension of the extractive economy—one that thrives on elite dominance and mirrors the very practices of industrial control and profit maximisation Karayiannides critiques. In this light, Musk’s trajectory becomes not just familiar but an echo of the past.

“Moniepoint attains Unicorn valuation”

Submitted by Tunde Okunoye | Doctoral Fellow

Moniepoint gains unicorn status after raising $110m from Google, DPI

Moniepoint, an increasingly famous name in Nigeria's fintech space, recently received $110 million in funding from investors including Google, to attain a valuation of $1 billion. This is a remarkable milestone for a company which only commenced operation in 2015.

Fintech players such as Moniepoint have earned their reputation as providers of excellent customer service with technical excellence. For example on the streets of Lagos the average owner of a road-corner kiosk panders to them because payments made by customers reflect immediately on fintech app accounts. For traditional brick-and-mortar banks basic transactions such as these take longer, and sullies the overall transaction experience.

An important question though remains whether they are able to maintain these levels of efficiency as they scale, and onboard numerous more customers.

“Greater trust in the state enhances citizens' willingness to pay taxes”

Greater trust in the state enhances citizens' willingness to pay taxes

This text explores the low willingness to pay taxes in developing countries, often due to a lack of trust in the state and its fiscal institutions. The author highlights that tax revenues in these countries, ranging from 10% to 20% of GDP, are significantly lower than those in OECD countries, limiting resources for essential public services such as health and education. This lack of trust is exacerbated by the perception that tax resources are mismanaged or diverted and that tax systems favor elites at the expense of low-income citizens. In fact, perceived injustice, worsened by tax exemptions for certain interest groups and an often inefficient administration in rural areas, undermines citizens’ fiscal compliance.

The author argues that traditional measures to strengthen tax compliance, focused on control and punishment, can be counterproductive, intensifying public resentment. An alternative approach suggests simplifying tax processes to minimize corruption and encourage the adoption of digital platforms, with an emphasis on transparency and equity. Examples like Uzbekistan and Rwanda show that reforms focused on transparency, tax progressivity, and anti-corruption can strengthen public trust, thereby increasing tax revenues. In conclusion, the article underscores that to boost tax revenues in these countries, it is essential to combine equity, transparency, and visible public services, making reforms more acceptable and strengthening the legitimacy of the state. However, further studies are needed on how the choice of solutions, such as digital platforms, can enhance trust and the implications of these technologies for the states and populations that utilize them.

“Can Zimbabwe’s legal framework promote foreign investment through the streamlining of visas?”

Submitted by Hannah Krienke | Doctoral Fellow | Trust

Zimbabwe’s shift towards attracting foreign investment has led to a streamlined immigration process and revised regulatory frameworks. This is done to draw international investors and skilled professionals through a simplified visa process, creating a more efficient and investor-friendly environment. In an interview with Vengai Madzima, Senior Partner at Madzima Chidyausiku Museta Legal Practitioners (MCM Legal), several key visa categories, including the Investor's Residence Permit and Temporary Employment Permit, are discussed as mechanisms to support foreign investment and labour mobility.

Zimbabwe could enhance its visa application process by leveraging digital platforms and integrating advanced identification systems, such as biometrics, to improve both security and transparency. With the assurance of a robust legal framework that safeguards foreign investors' rights while aligning with national interests would further boost the country's appeal as an investment destination. To attract foreign investment and promote tourism, Zimbabwe’s immigration process must be transparent, secure, and efficient. This requires a digital trust infrastructure capable of authenticating documents and verifying identities through secure databases and cross-border systems. Without such infrastructure, authorities would face challenges in ensuring the integrity of the information submitted by applicants, making it harder to prevent fraud or abuse of the system.

“Ghana is gearing up for its election in December”

Submitted by Caroline King | Doctoral Fellow | Trust

Main Ghana opposition leader tipped to win presidential vote, poll shows

Although posters of presidential candidates have plastered Accra’s streets for most of 2024, the last months before the election have seen an increase in campaigning around the country. The forthcoming election cannot be ignored any longer, as campaign trucks with loud music and political party-logos drive up and down every street of the city and Sunday afternoons are filled with meetings discussing Ghana’s political future in backyards and the streets.

Opinion polls are showing a trend towards a win for the current opposition party, with former President Mahama (NDC) running for office again. During his previous term he heavily invested in Ghana’s infrastructure, but his government faced allegations of corruption, although Mahama was not personally accused. His government also decided to move forward with the GhanaCard project, previously introduced through the NPP government in 2004/ 2005. His opponent, Bawumia is the current Vice-President of Ghana and running for the NPP, and is also one of the main figures behind the push for digitization in the country, and thus also the GhanaCard. But the NPP has also faced an array of corruption allegations and has been challenged by Ghana’s worst economic crisis in a generation, instilling little to no trust in the country’s citizens. Their main concerns remain on the economy, infrastructure, jobs and education. The election on 7th December will most likely result in a run-off vote towards the end of the year, with Mahama favored to win.

Although the independent candidates try to become visible through poster campaigns around the city, neither the news nor Ghanaians see a prospective win, but rather stick to the two main parties or decide not to vote at all. The situation in Ghana remains overall calm with the election in a few weeks, although this might change as the date comes closer.

“Quality of Life and Trust in Municipalities”

Submitted by Joel Pearson | Postdoc Fellow | Trust

The most recent Quality of Life Survey conducted by the Gauteng City-Region Observatory (GCRO) offers fresh insights into the complex relationship between the local state and residents of Gauteng’s nine municipalities (metros and local). When compared with previous survey results, the report registers a decrease in satisfaction with various municipal services like water, energy supply, sanitation, refuse removal, roads, streetlights, and the cost of these services. This has been accompanied by a significant increase in negative perceptions of the government at all levels – national, provincial, and local. There also appears to be declining trust in the political process more broadly, with the survey suggesting increased levels of political disengagement among many residents: over half (54%) believe politics is futile, while a considerable portion of eligible voters (28%) expressed their intention not to vote or were uncertain about voting in the 2024 elections, primarily due to a belief that “they had no power to change things” with respondents “saying that their vote would not make a difference, or that they did not like politics and broken promises”. On the other hand, the report signals a rise in engagement with other local structures since the pandemic, with respondents noting increased involvement in ward meetings, street committees, residents' associations, community development forums, integrated development planning meetings, mayoral imbizos, and school governing bodies. This may suggest a desire for increased engagement at the local level. This latest GCRO survey provides valuable data to inform qualitative research, which is required to offer explanations for these numerical trends and assess the shifting nature of trust between state and society.

Trust in Transition is a Substack, by the Trust Project, exploring the intricate interplay between trust, finance, and societal evolution within the African context. This space serves as a lens into the fascinating dynamics of trust infrastructures, financial landscapes, and their transformative impact on Africa's economic pathways.