Welcome to the October edition of Trust in Transition. This monthly newsletter, compiled by WISER scholars, is your gateway into finance, technology, and trust in Africa. Each month, the Substack features WiSER scholars unpacking the current events and stories shaping their research.

September Recap 🗓️

The seventh lecture in the series on the unified theory of trust was held on August 29th and delivered by Keith Breckenridge in discussion with Laura Phillips and Efthimios Karayiannides.

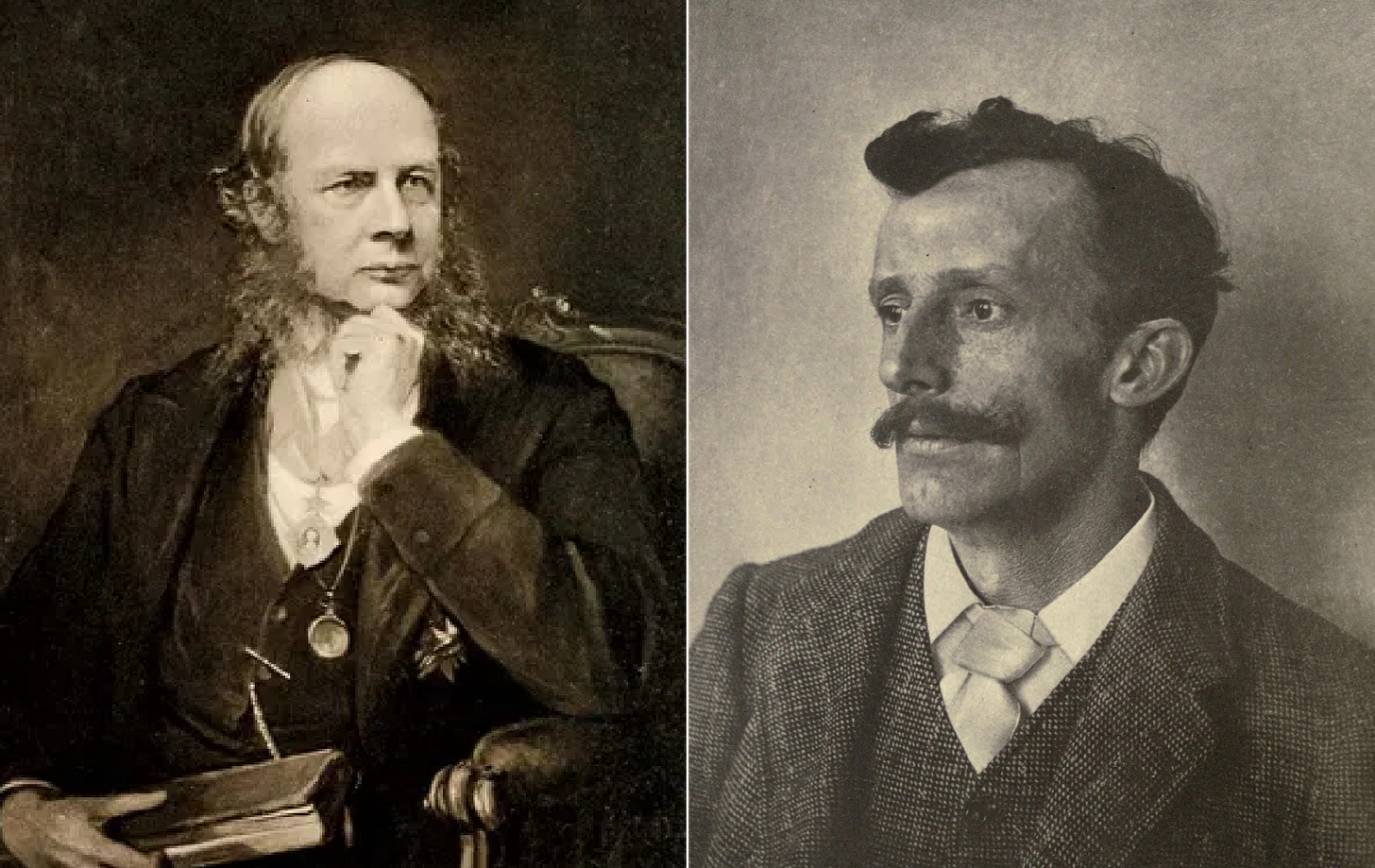

This lecture explored the contrasting doctrines of trust proposed by the legal historians and Cambridge law professors, Henry Maine and FW Maitland, and some of the reasons for the popularity of Maine and the resistance to Maitland in South Africa, and the rest of the colonial world.

The significance of Henry Maine’s Ancient Law (1861) in justifying despotic forms of indirect rule and the overturning of the 19th century laissez faire changes in property and credit in rural India and Africa has been richly explored (see Diamond, Mamdani, Mantena). Maine’s theory and his claims about patriarchal despotism in traditional society and the civilisational transition from collective to individualised forms of property were overthrown by Maitland’s much more careful research on the history of corporate property forms (Burrow, Eldridge, Kirby). The two historians were also proposing antithetical models of trust – Maine’s modelled on Roman family law and Maine’s on the English law of equity. It was Maine’s argument about despotic patriarchal trust that came to dominate colonial native policy, and while Maitland’s teaching on the law of equity has gone on to structure the law of trust, especially in finance, in the English-speaking world, in South Africa it was carefully resisted. The lecture offers some explanations on why this was, and what its effects have been on our trust law.

⭐ The WiSER Feature:

“Tax and Trust: State-Society bargains in Lagos State Nigeria” Tunde Okunoye

Read below ⬇️

In this edition, Wiser Trust scholars and affiliates are reading the following:

“Strengthening Trust through Digital Diploma Verification in Cameroon” Georges Eyenga | Postdoc Fellow | Trust

“Zero Trust Strategies for Protecting Africa’s Data: Lessons from the US” Raymond Onuoha | Postdoc Fellow | Trust

“Why the Times Are in Fact Precedented” Fatima Moolla | Doctoral Fellow | Trust

“The Digital Battlefield: Israel's Use of AI and Intelligence in Modern Warfare” Youssef Mnaili | postdoc Fellow

“#StopGalamsey” Caroline King | Doctoral Fellow | Trust

“Burkina Faso’s shift to Biometric passports furthering inclusion or oppression?” Hannah Krienke | Doctoral Fellow | Trust

“Old Mutual in 16 million rands worth of trouble” Laura Phillips | Senior Researcher | Trust

“Ghana strikes foreign debt restructuring deal” Keith Breckenridge | Trust

“Development Trust takes on Abusive Chiefs” Joel Pearson | Postdoc Fellow | Trust

This edition highlights key themes around trust, governance, and technology across Africa. From digital diploma verification in Cameroon to zero trust data strategies, our scholars explore the evolving role of technology in safeguarding and verifying information. Discussions also address the geopolitical implications of AI in warfare, as seen in Israel’s military strategies, and the ethical debates surrounding biometric passports in Burkina Faso. Financial trust surfaces through analyses of Old Mutual's compliance troubles and Ghana's foreign debt restructuring. Each contribution sheds light on the dynamic relationship between trust, technology, and governance in shaping Africa’s future.

The WiSER Feature 📝

Tax and Trust: State-Society bargains in Lagos State Nigeria

Tunde Okunoye

Nigeria, like many African countries, has a tax capacity problem (Tagem and Morrissey 2022). Tax revenue as a percentage of Gross Domestic Product (GDP) is low. While tax revenues as a percentage of GDP average about 33% in OECD countries, the figure for Africa was 16% in 2020 – some five percentage points below Asia and the Pacific. Although taxes have historically been collected from mineral exploration, international trade (exports and imports), and Value Added Tax (VAT); other forms of taxation, particularly income, corporate and property tax - which are a mainstay of many advanced economies, have lagged behind.

Some of this reticence to tax incomes, properties and businesses stems from a desire to maintain stability. There is ample literature suggesting that violence is intricately woven into the fabric of African societies (Debos 2016) and any government which is perceived as over-burdening citizens might soon find itself contending with the violence of mass protests. Hence scholars have suggested that taxation could be the basis for a peaceful contest between citizens and the state, rather than a toxic and violent one, as a tax-paying public demands better service delivery from the government.

However, even this observation is linked to a deficit in the state-citizen contract. The reason why many citizens in towns and cities might revolt against a state seeking to expand its tax net is because of a Trust deficit: the perception that the government does not keep its own side of the state-society contract. As Adebanwi has shown, in Nigeria at least, prebendalism (Adebanwi and Obadare 2010) is a really useful way of explaining how government works, and generations of Nigerians have already resigned themselves to the reality that public officials will enrich themselves from the public purse. This is why any attempt to further expand the sphere of that prebendalist corruption into the arena of personal income tax, property and corporation tax - which are the spheres of private toil — is usually fraught with tension.

This is a major reason why Internally Generated Revenue (IGR) within the 36 states comprising Nigeria has been historically low. The states simply rely on the monthly allocations from the Federal Government, mostly from crude oil exports, to finance their governments. Until recently, Lagos state was the only exception to this rule. The other recent addition is Ogun state, a neighbouring state which benefits from its economic proximity to Lagos.

How did Lagos break the trend of low tax collection capacity in Nigeria? This article attempts to map some of the political dynamics (Kjær, Ulriksen, and Bak 2023) of tax revenue bargaining in Nigeria, and how Lagos navigated Nigeria’s historic state-society Trust deficit. To fully understand this is to unravel the political-economy of Nigeria between 1999-2007 when Governor Bola Ahmed Tinubu was the governor of the state. He is now the President of Nigeria. A coalescence of unique political incentives, constraints and strategies forged by the political realities of those 8 years (during a return to democracy after decades of military rule in Nigeria) partly explains why many states in Nigeria now go to Lagos to learn the intricacies of IGR generation.

First the geo-economic context. The rise in tax revenues in Lagos state during this time was achieved largely by corporate taxes and property taxes. Lagos is the economic nerve centre and engine of Nigeria, has its largest sea and air port, and the majority of the largest firms in the country have their operations there. Lagos is also the most populous and urbanised state in the country, which creates a huge property tax opportunity for the state government.

The political context was marked by the reality that in the years 1999-2007, Lagos state was one of 6 states in Nigeria’s southwest which were in political opposition to the People Democratic Party (PDP) which controlled the Federal Government and most of the remaining 30 states in the Nigerian Federation. These 6 states were controlled by the Alliance for Democracy (AD), which was contesting political control over the country. By the 2003 electoral cycle, only Lagos remained within the control of the AD and it came under heavy constraints to generate revenue for its administration and for reviving the political fortunes of its parent party. All this while it was confronted with economic hurdles erected by the Federal Government to strangle the last major bastion of political opposition to its rule.

These political and economic constraints forced a high level of state-society accountability (Gramont 2015) and reciprocity which is not usually the norm in Nigerian politics, showing that political competition can create strong reform incentives. Under immense pressure from the Federal Government politically and economically, the political leaders of Lagos had to demonstrate good governance and accountability in order to have any chance of retaining political power in the next electoral cycle. Also key to retaining that power was tax-generated revenue, which reached unprecedented levels when the state began to demonstrate to its residents, particularly the business community (sources of corporate tax), that their tax contributions were reflected in visible, tangible developmental and infrastructural dividends within the state. Naturally, these gestures induced more willingness to pay taxes.

This was also accompanied by an effective communication strategy which endeavoured to show the residents of Lagos that taxes were being used judiciously (Kjær, Ulriksen, and Bak 2023). This observed behaviour tallies with research (Kjær, Ulriksen, and Bak 2023) on Africa which suggests that governments negotiate with tax revenue providers on the shape and details of tax contributions, although, unlike observed in Lagos, this does not always lead to political accountability or improvements in public service delivery. Nevertheless, it does stimulate government responsiveness to the public and more regular engagements with the public, thereby cultivating state-society Trust. Through this coerced demonstration of accountability by state officials constrained by the need to shore up finances and political relevance, Lagos state grew its IGR to levels where it was no longer dependent on the monthly allocations from the Federal Government.

In addition to raising the level of tax revenue, this state-society bargaining in Lagos also worked well politically. The opposition APC was able to leverage the political base of Lagos, bolstered by high IGR, to rebuild the party. Their success is demonstrated by the fact that the APC (metamorphosis of AD) has led the Federal Government since 2015 when it successfully won the Presidential elections. The APC signaled its intention to replicate the Lagos tax success at the national level when it appointed (Nairametrics 2015) the Lagos tax boss as the national tax boss in 2015. Today, the former Governor of Lagos state, Bola Tinubu, is also the President of Nigeria.

References/Bibliography

Adebanwi, Wale, and Ebenezer Obadare. 2010. Encountering the Nigerian State. Africa Connects. Palgrave Macmillan.

Debos, Marielle. 2016. Living by the Gun in Chad: Combatants, Impunity and State Formation. Zed Books Ltd.

Gramont, de Diane. 2015. ‘Governing Lagos: Unlocking the Politics of Reform’. Carnegie Endowment for International Peace (blog). 12 January 2015. https://carnegieendowment.org/research/2015/01/governing-lagos-unlocking-the-politics-of-reform?lang=en.

Kjær, Anne Mette, Marianne S. Ulriksen, and Ane Karoline Bak, eds. 2023. The Politics of Revenue Bargaining in Africa: Triggers, Processes, and Outcomes. 1st ed. Oxford University PressOxford. https://doi.org/10.1093/oso/9780192868787.001.0001.

Nairametrics. 2015. ‘[TAX] Buhari Appoints Former LIRS Boss As New FIRS Chairman’. Nairametrics (blog). 20 August 2015. https://nairametrics.com/2015/08/20/buhari-appoints-lagos-revenue-boss-as-firs-chairman/.

✏️ Contributions:

“Strengthening Trust through Digital Diploma Verification in Cameroon”

Submitted by Georges Eyenga | Postdoc Fellow | Trust

Le Cameroun déploie une plateforme numérique pour en finir avec les faux diplômes

Cameroon has recently launched a digital platform aimed at verifying the authenticity of diplomas issued by its educational institutions. This initiative, announced at the University of Yaoundé 1, seeks to combat the issue of fake diplomas while improving the efficiency of public sector recruitment. In response to a rise in fraud cases, such as the 1,300 fake diplomas detected during recruitment processes last June, the platform will enable fast and secure verifications, thereby enhancing transparency and trust between citizens, employers, and public institutions. This project contributes to modernizing Cameroon's public administration and highlights the importance of technology in ensuring the integrity of educational and administrative processes. The new digital diploma verification platform in Cameroon strengthens trust in infrastructure by improving the transparency and reliability of administrative processes. By automating diploma verification, it reduces the risks of fraud and human error, thereby increasing the confidence of citizens, employers, and public institutions in the authenticity of the qualifications presented. Moreover, this initiative demonstrates the state’s ability to modernize its services and adopt effective digital solutions, thus reinforcing the legitimacy of institutions and overall trust in the country’s technological and administrative infrastructure. The limitations of this project include unequal access to technology, especially in rural areas, as well as concerns about data security and the reliability of databases. Additionally, resistance to change among certain stakeholders and over-reliance on the platform in case of outages could also pose challenges.

“Zero Trust Strategies for protecting Africa’s data: Lessons from the US”

Submitted by Raymond Onuoha | Postdoc Fellow | Trust

Governments still struggling to secure data. Zero-trust, passkeys could help

In July 2024, the National Social Security Fund (CNPS) of Cameroon faced a major data breach that compromised the personal and financial information of over 1.5 million citizens. The cybercriminal group "The Space Bears" claimed responsibility, exposing the critical vulnerability of Africa's digital infrastructure. As Africa’s digital economy expands, the need for robust cybersecurity strategies becomes increasingly urgent.

One approach gaining traction globally is the "zero-trust" security model, which is already being implemented in the United States. In response to escalating cyber threats, the U.S. government issued an executive order in 2021, followed by a 2022 memorandum, requiring federal agencies to adopt zero-trust architecture by the end of the 2024 financial year. This model shifts the security paradigm from assuming trust within an organization’s network to continuously verifying and monitoring all users, devices, and data flows, regardless of their location.

Africa can draw key lessons from the U.S. zero-trust strategy. By implementing a similar approach, African governments and organizations can reduce the risks of cyberattacks by minimizing data access points and increasing continuous verification protocols. As digitalization accelerates across the continent, adopting zero-trust architectures will not only safeguard sensitive data but also build public trust in digital services—a crucial factor in Africa's evolving data governance landscape.

“Why the Times Are in Fact Precedented”

Submitted by Fatima Moolla | Doctoral Fellow | Trust

In the constant barrage of digital news, we are often told that the events we witness are "unprecedented." Whether it's Israel’s bombardment of Lebanon, Sudan’s cultural crisis, or floods in North Carolina, each disaster is framed as if it stands apart from history. But is that really the case? In reality, much of what we see today is the direct result of longstanding processes. Climate disasters are not sudden; they stem from decades of environmental degradation. Financial crises? We’ve seen them before—rooted in systems that reward inequality and speculation. Even human rights violations, though presented as new horrors, follow patterns shaped by geopolitics and colonial legacies. The truth is, we are both the catalyst and the cause of these crises. We must challenge the idea that today's crises are unforeseen. These events are not random but inevitable outcomes of our collective actions—our failure to address the underlying causes of climate change, war, economic instability, and, crucially, the erosion of social trust. Labeling them "unprecedented" can make them easier to digest, but it also blinds us to the fact that they have long been in the making.

Take the trust crisis, for example. The erosion of trust in institutions, governance, and systems hasn’t suddenly emerged. It’s been growing slowly over time, compounded by failures in transparency, accountability, and ethical leadership. Yet, when it reaches a breaking point, there will be those who call it an "unprecedented crisis of trust." But in truth, this is a challenge we’ve been heading toward for years. It is a direct result of neglecting good governance and accountability. And when it fully catches up to us, calling it unprecedented will be too late to make a meaningful change.

“The Digital Battlefield: Israel's Use of AI and Intelligence in Modern Warfare”

Submitted by Youssef Mnaili | Postdoc Fellow

These two articles, “How Israeli Spies Penetrated Hezbollah” from the Financial Times and “Lavender AI: How the Israeli Army Uses AI to Wage War in Gaza” from +972 Magazine, provide insights into Israel’s evolving military strategies, particularly regarding its use of intelligence and digital technologies in Gaza and Lebanon. The Financial Times article emphasizes Israel’s enhanced intelligence capabilities, which have significantly transformed its approach to warfare, especially in its ongoing conflict with Hezbollah. It explains how Israel turns a vast amount of publicly available data on Hezbollah into actionable military intelligence, mining obituaries and social media posts to map the organization’s membership, along with their family and social networks. This capability peaked during Hezbollah’s intervention in Syria. In contrast, the +972 Magazine article focuses on the Israeli military’s application of artificial intelligence (AI) and machine learning in its operations in Gaza. It highlights the integration of AI systems that analyze social media data, aerial surveillance, and other digital information to target attacks. The use of AI in warfare raises critical ethical questions regarding the implications of algorithm-driven military strategies, particularly concerning civilian casualties and accountability. The utilization of digital infrastructure by Israel in its military operations signifies a profound shift in how conflicts are conducted, underscoring the importance of intelligence and technology in contemporary warfare. As these technologies continue to evolve, the impact on the nature of warfare and the ethical considerations surrounding their use will remain crucial areas for ongoing discussion and analysis.

“#StopGalamsey”

Submitted by Caroline King | Doctoral Fellow | Trust

Galamsey: Akufo-Addo directs Defence Minister to deploy additional military forces

Galamsey, a term referring to small-scale illegal mining in Ghana, is not a new phenomenon in the country and has been going on for as long as big companies have been mining. But the increase in the gold price has led to the pollution of rivers and forests by galamsey miners, which has led to outcries among Ghanaians, coining the #stopgalamsey hashtag and a subsequent social movement.

During peaceful protests in Accra in September, many protesters were forcefully detained and held in inhumane conditions, leading to more protests over the past weeks. Ghanaians are demanding action from the current government as well as the opposition parties, especially in relation to water pollution, which will have far reaching implications for Ghanaians’ health and well-being, eventually creating a rift between people who can afford imported clean water and those who are left drinking polluted water. Pressure from citizens as well as unions to go on strike have led to a presidential press release that states more military power will be deployed to halt any mining in designated red zones. But the demand for a state of emergency, which would legally halt all activity in the affected areas, was not declared, thus falling short of the demands made by the “Coalition Against Galamsey”.

The fact that the government has been dragging its feet around this issue to the point of precarity might be related to the lucrative business of gold exports, projected to reach over $10 billion by the end of 2024. The shocking figure here is that 36% of this revenue is won through galamsey mining, a profit margin deemed high enough for the government to accept the pollution of its population and natural resources, once again not thinking beyond the immediate monetary benefit.

“Burkina Faso’s shift to Biometric passports furthering inclusion or oppression?”

Submitted by Hannah Krienke | Doctoral Fellow | Trust

New Burkina Faso biometric passport further cements ECOWAS departure

In a recent shift towards greater access to biometric passports, the military junta of Burkina Faso has introduced a new passport that citizens can apply for online, eliminating the need to travel to major cities. This initiative is part of the junta's political strategy to distance itself from the Economic Community of West African States (ECOWAS) as the new passport lacks the ECOWAS logo. While this change is a positive step towards improving access to identification documents essential for enhancing social and financial accessibility there are concerns about the implications for citizens' privacy in an already militarised state. The passports are produced by the Chinese firm Emptech, indicating a close relationship between the military regime and China which could further impact ordinary citizens. The use of biometric technology raises concerns about surveillance and control, particularly under a government with no restrictions on its power. Additionally, the success of this biometric initiative will depend on public trust, as citizens may fear the misuse of their data. While the new biometric passport enhances accessibility, it also highlights the complex interplay between technology, governance, and civil liberties in Burkina Faso's evolving political landscape.

“Old Mutual in 16 million rands worth of trouble”

Submitted by Laura Phillips | Senior Researcher | Trust

In late September South African news reported that Old Mutual Life Assurance Company, one of the largest financial services companies in the country, had been fined close to R16 million for failing to meet compliance requirements set out by the Financial Intelligence Centre Act. Though the fine is not evidence itself of terrorism or illicit money flows - as some reporting has gestured towards - it does suggest that South Africa's systems are not tight enough to prevent financial institutions from being co-opted by malicious actors. Dramatic as the R16 million fine is though, it can only be understood in the context of South Africa's greylisting by the Financial Action Task Force and the desperate attempts to rescue South Africa from pariah status.

“Ghana strikes foreign debt restructuring deal”

Submitted by Keith Breckenridge | Trust

Working with the support of the IMF, the Ghanaian government has finalised a deal with the holders of its eurobonds that cuts the value of the outstanding debt, much of it held by private banks, by 37%. This follows an earlier agreement with governments and multinational institutions that was not made public. What's intriguing about this current agreement is that Ghanaian financial analysts believe that informal mining is a bigger political problem than external debt. "The government’s ability to address the impact of galamsey on the local economy is a more critical factor in the elections than the debt restructuring programme,” Daniel Amayeye Anim says. Yet the artisanal miners now a key source of the dollars needed to pay for the debts, with the government announcing recently that Ghana's gold exports (36% of it from small-scale miners) will reach $10bn in 2024.

“Development Trust Takes on Abusive Chiefs”

Submitted by Joel Pearson | Postdoc Fellow | Trust

Challenging Unconstitutional Tribal Levies in Limpopo

Trusts rarely attract good news in portrayals of rural South Africa today. This is particularly true of community trusts established in mining-affected areas: ostensibly a means of distributing a portion of mining revenues to local communities, these have often been used as vehicles for elite capture instead - particularly at the hands of chiefly elites, or those who style themselves as such. Yet this article speaks of how trusts can be put to more progressive uses to protect vulnerable rural residents. Last month, the Legal Resources Centre represented members of seven traditional communities in Limpopo and Nkuzi Development Trust in the Constitutional Court in a bid to confirm an earlier high court order that found that the imposition of taxes, levies and rates by traditional councils - practices reminiscent of apartheid-era practices of chiefly extortion - is unconstitutional. The outcome of this case has the potential to offer far greater protection for local community members across the country from forms of rent-seeking which threaten household incomes in already impoverished communities.

Trust in Transition is a Substack, by the Trust Project, exploring the intricate interplay between trust, finance, and societal evolution within the African context. This space serves as a lens into the fascinating dynamics of trust infrastructures, financial landscapes, and their transformative impact on Africa's economic pathways.